This case study explores the pricing strategy challenges faced by a high-growth UK-based B2C tech start-up, whose well-intentioned price increases led to unforeseen consequences that nearly destabilised the business. Amidst high-pressure investor expectations, the firm’s unique pricing model, which locked in initial purchase prices for customers’ lifetime, was misaligned with an effective revenue growth and profitability strategy. Following two price hikes, new customer acquisition slowed, churn rates increased, and profitability deteriorated. This paper provides insights into the root causes, the comprehensive audit approach employed, and the critical steps taken to realign the company’s pricing for sustainable growth.

Background and Context

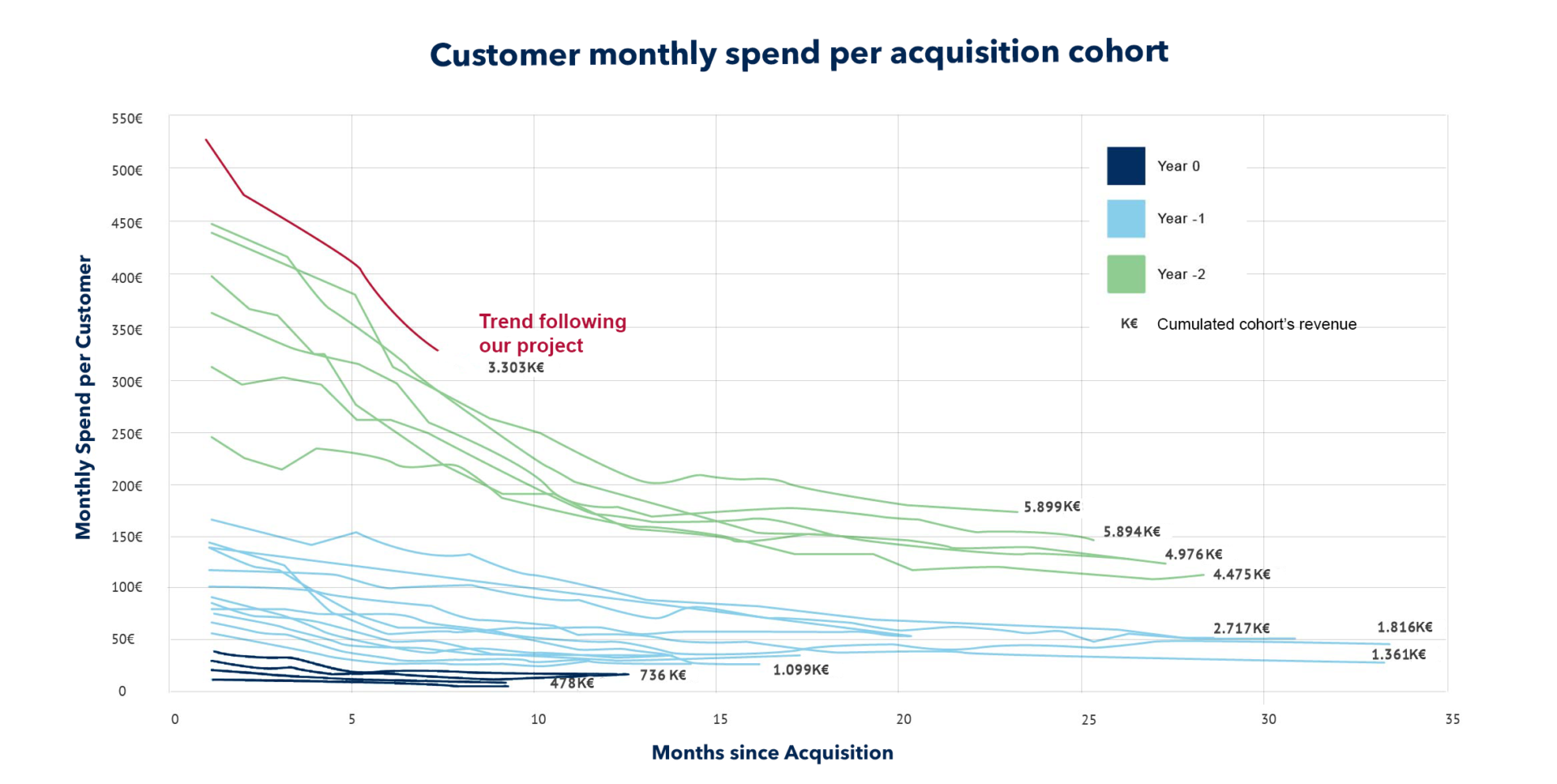

The start-up’s Executive Committee (ExCo) was under significant pressure from venture capital investors to increase prices continually. The business model, generating £92 million in annual revenue, operated on a subscription structure that locked in the initial purchase price for the customer’s lifetime, restricting the company from updating prices for existing customers. Price increases only impacted newly acquired customers, complicating the task of analysing revenue and profitability impacts across customer cohorts. With new customer acquisition slowing, market demand shifting, and sales on a downward trend, the leadership team recognised the need for a deeper assessment of their pricing impact before implementing another price hike.

Key Challenges

A structured pricing audit revealed issues far beyond market demand misalignment, highlighting core strategic challenges:

- Over-Reliance on Existing Customers: 86% of revenue stemmed from existing customers, as new customer growth had plateaued.

- Revenue Decline in New Customer Segments: Data indicated that each price hike corresponded with an immediate drop in new sales, with new customers generating only one-third of the revenue of previous cohorts. The decline in performance was not detected as financial metrics were analysed by purchase month rather than customer cohort (acquisition date

- Failed Sales Promotions: Reactive promotions aimed at counteracting the adverse effects of higher prices increased acquisition costs without driving sustained sales growth.

- Increased Churn Rates: Newly acquired customers showed higher churn rates and shorter customer lifetime value (CLV), eroding profitability.

- Costly Lead Generation Channels: Attempts to drive new acquisitions via lead generation partnerships spiked customer acquisition costs (CAC) while failing to deliver profitability, as minor price increases made the company less competitive in market rankings.

- Biased A/B testing: Performance in acquisition channels was replicated in a different context, leading to adverse results.

- Profitability Erosion: Detailed analyses indicated that newly acquired customers from higher-priced cohorts and new channels were operating at a loss, challenging the long-term financial viability of the pricing approach.

Strategic Response and Action Plan

The audit identified critical areas where pricing strategy adjustments were essential to restore growth and profitability. The following actions were taken:

- Customer-Level Profitability Analysis: A comprehensive analysis mapped the impact of price increases on CAC, CLV, and overall profitability. This segmentation allowed for a granular view of customer behaviour and profitability across product lines.

- Cross-Functional Collaboration: Cross-departmental workshops with product, marketing, analytics, and sales functions enabled the development of a customer profit-and-loss (P&L) model. This collaborative approach led to a shared understanding of the pricing impact across the organisation.

- Executive Case Development: Armed with a robust data-driven model, the ExCo was equipped to present a compelling case for prioritising long-term profitability over short-term pricing gains. The insights allowed leadership to shift from a reactive to a strategic approach, positioning pricing changes within the broader growth objectives.

- Controlled Pricing Tests: A series of controlled tests were implemented to find the optimal pricing that balanced CAC, CLV, and market competitiveness. The test framework provided a refined understanding of price elasticity across customer segments, informing an adaptive pricing strategy.

- Customer Segmentation: The tests uncovered distinct customer segments with varying price sensitivities, enabling targeted pricing strategies that aligned with customer willingness to pay and profitability.

With data-supported recommendations, the Chief Product Officer (CPO) and ExCo presented the board with a compelling case for long-term strategic pricing, showcasing sustainable growth in line with market demands. This alignment of pricing strategy with customer needs allowed the start-up to mitigate investor pressure and establish a clear path toward stable, profitable expansion.

Outcomes

The refined pricing strategy produced the following results:

- Stabilised Sales and Increased Profitability: Post-test sales surpassed previous levels, with an 8% improvement in revenue in comparison with Year -2 levels.

- Reduced Customer Churn and Enhanced Tenure: Lower prices improved competitiveness, leading to organic customer acquisition and lower CAC, alongside enhanced customer retention.

- Sustainable Growth Model: With pricing realigned to market dynamics, the company achieved a balanced approach to pricing, providing clear metrics for future adjustments. These strategic shifts reassured investors and provided a sustainable growth path that aligned with market conditions.

Conclusion

This case serves as a compelling example within the white paper, highlighting the critical role of pricing expertise and thorough analysis in successfully managing a price increase. The challenges faced by the tech start-up demonstrate that, without a disciplined approach, price adjustments can easily backfire—leading in this case to reduced customer acquisition, accelerated churn, and declining profitability.

The findings reinforce that companies contemplating a price increase must prioritise building strong pricing capabilities and conducting detailed, cross-functional analyses. This ensures that pricing decisions align with customer behaviour and market positioning, minimising the risk of unintended consequences. By leveraging specialised pricing expertise and proven frameworks and methodologies, organisations can better balance immediate revenue objectives with sustainable, long-term growth, ultimately avoiding the costly pitfalls illustrated in this case.