I’ve seen an increase in clients reaching out to address a situation that’s becoming all too common: facing harsh competition from Chinese new entrants. The conversation usually starts with frustration: “Their product is pretty good and they’re much cheaper than us on price.” What should we do?

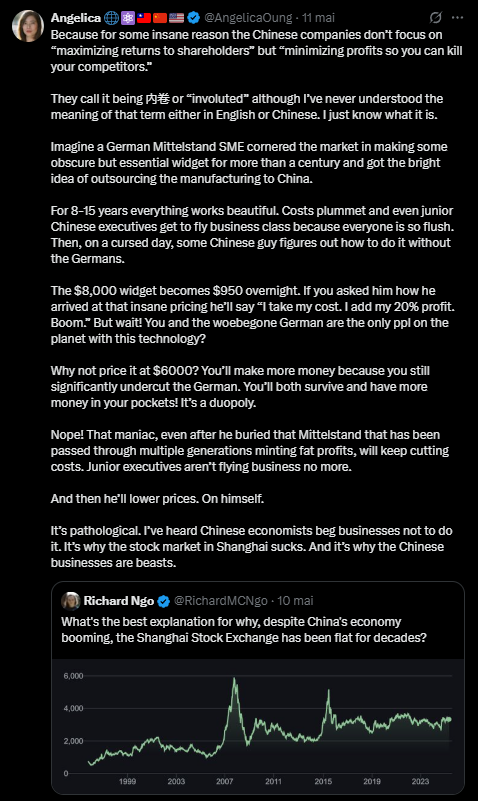

I came across a viral tweet that captured this perfectly. It asked why, despite China’s booming economy, the Shanghai Stock Exchange has been flat for decades. The answer? Because many Chinese companies don’t focus on maximizing shareholder returns, they focus on minimizing profits to eliminate competitors.

It reminded me of the dynamic we see today between Tesla and BYD. BYD now outsells Tesla roughly 3-to-1 in unit terms, more than 2 million vehicles in the first half of 2025 versus Tesla’s ~720,000, but investors continue to value Tesla almost ten times higher. The contrast captures the essence of pricing power versus cost leadership: Tesla’s profitability and perceived innovation sustain its valuation, while BYD’s aggressive pricing drives scale but limits financial returns. Tesla has built its market position around innovation, premium pricing, and healthy margins. BYD, by contrast, has pursued aggressive cost leadership slashing prices repeatedly, even as its profits and share price fluctuate wildly. The result is that Tesla remains one of the most valuable companies in the world, while BYD’s valuation tells a more modest story, despite its massive production volumes.

Both make great cars. But only one is rewarded by the stock market.

Competing for Market Share vs. Competing for Profit

What we’re seeing with Chinese manufacturers, whether in electric vehicles, solar panels, or industrial components isn’t just competition. It’s a clash of corporate goals.

Many companies still chase market share as the ultimate metric of success. It’s a mindset rooted in the belief that scale guarantees survival. But as pricing research consistently shows, market share is not a strategy, it’s an outcome.

Profit is the cost of survival. And price is the most powerful lever to generate it.

When a company prioritizes sales volume or revenue growth over profitability, it eventually destroys shareholder value. It’s why the Shanghai and Shenzhen stock indices have underperformed for years despite record economic growth. The obsession with competitive pricing has eroded margins across entire industries.

The Price War Spiral

Once the first price cut happens, the price war begins. Competitors undercut each other until everyone is worse off.

In a duopoly or oligopoly, rational pricing behavior (where competitors implicitly cooperate to maintain healthy margins) can lead to long-term profitability. But when one side adopts an aggressive, almost self-destructive pricing stance, the entire market suffers.

This is what economists call involution (内卷): an endless cycle of internal competition where no one truly wins. It’s why so many Chinese companies, despite global dominance in manufacturing, struggle to deliver consistent returns to investors.

Only the player with the lowest cost structure survives, and even then, with razor-thin margins.

When Cost-Cutting Becomes a Culture

Competing solely on price forces companies to make money “on the inside.” Costs are slashed, quality corners are cut, and morale declines.

As I’ve told my clients many times, when you choose to compete on price, it becomes a downward spiral. Executives stop flying business class, stop travelling to meet clients, stop hiring the best talent. You end up manufacturing an “acceptable” product with the bare minimum resources, and in that game, the Chinese competitor always wins. It doesn’t take long before your clients realise you became just another slightly more expensive low-cost option.

Cost discipline is essential, but you can’t cut your way to prosperity. Sustainable profitability comes from a combination of pricing power, innovation, and disciplined cost management, not from racing to the bottom.

Lessons for European and US Manufacturers

Many European industrial firms walked into this trap when they outsourced to China to save on production costs. They gained short-term margin expansion, but unintentionally created their future competitors.

To avoid being trapped in the same dynamic, manufacturers need to rethink how they approach pricing strategy:

- Compete on value differentiation, not cost parity.

- Treat costs as the floor, not the compass, of your pricing decisions.

- Introduce fighter brands or simplified product lines to defend against low-cost entrants without eroding flagship pricing.

- Align the organization,from sales to finance, around profit as the primary goal, not volume.

When I work with industrial clients, this is often the real turning point: shifting from reactive pricing (“we need to match them”) to strategic pricing (“we need to price for what we’re worth”).

The Bigger Picture

The tweet called it “pathological.” I’d call it cultural, but also instructive.

The aggressive pricing behavior that has driven China’s manufacturing rise also limits its financial markets’ performance. It’s a paradox: the same competitiveness that conquered global supply chains prevents those companies from creating sustained shareholder value.

It’s a reminder for everyone else: the purpose of business isn’t to sell more. It’s to earn more.

Price is not just a number. It’s a reflection of how you value your business.