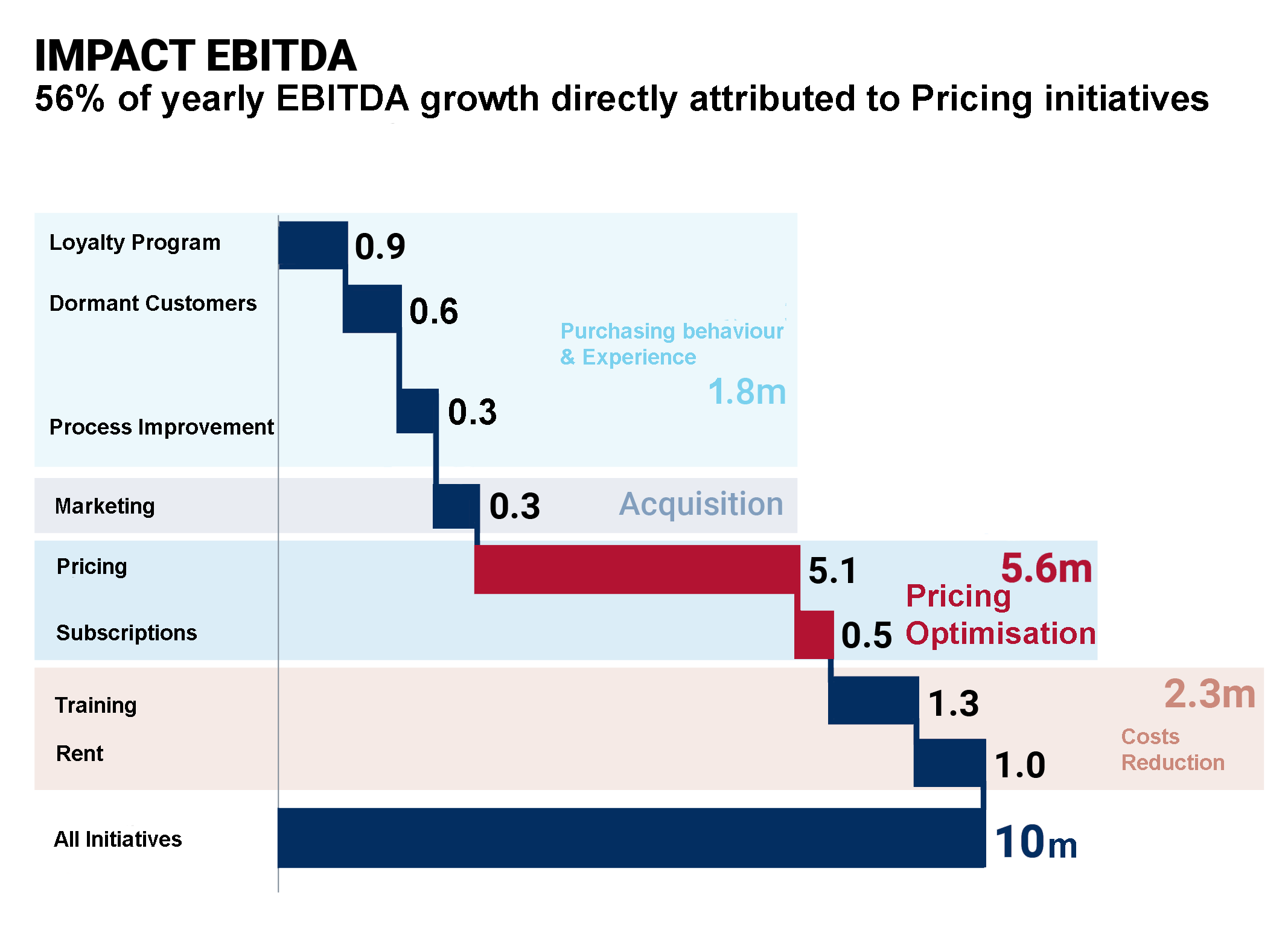

In private equity (PE), where value creation is paramount, pricing is critical for driving profitability and ensuring portfolio companies achieve their full potential. While cost reduction often takes centre stage in PE strategies, pricing optimisation often delivers more significant value.

Why Pricing Matters in Private Equity

Private equity firms typically acquire companies with the aim of rapidly increasing profitability and exiting at a higher valuation. While cost-cutting initiatives are common, they have diminishing returns in competitive markets. Pricing, on the other hand, directly impacts both revenue and margins, offering a scalable and sustainable way to enhance profitability.

Yet, many portfolio companies struggle with pricing due to outdated strategies, fragmented processes, or resistance to change. For PE firms, addressing these challenges can unlock significant value during the holding period.

Opportunities for Value Creation through Pricing

- Shifting Focus from Costs to Value

PE-backed companies often inherit a cost-centric mindset. Transitioning to value-based pricing helps capture the full value of their offerings, aligning prices with customer willingness to pay rather than internal costs. - Market-Based Strategies

Understanding market dynamics and customer segments is critical for pricing success. PE firms can drive portfolio companies to adopt strategies like:- Skimming Pricing for innovative offerings in early stages to maximise profit from early adopters.

- Penetration Pricing for capturing market share in competitive industries.

- Post-Merger or Acquisition Pricing Optimisation

Mergers and acquisitions create unique opportunities to reevaluate pricing strategies. PE firms can drive revenue synergies by harmonising pricing models, addressing pricing inconsistencies, and leveraging combined customer bases. - Leveraging Pricing Tools and Analytics

Advanced pricing tools can help portfolio companies identify pricing leaks, optimise discount structures, and forecast customer behaviour. These insights empower data-driven decisions that maximise value capture. - Monetising Enhancements

Pricing should reflect the enhanced value delivered through product improvements or added services. PE firms can encourage portfolio companies to regularly revisit their pricing as they innovate or expand offerings. - Enforce higher prices through better governance

The pricing governance at a firm and the way prices are set and enforced impact directly the price levels that are charged to customers. By investing in the pricing organisation, PE firms directly reduce discounting and revenue leakage.

Risks to Manage in Pricing Optimisation

- Customer Pushback and Churn

Aggressive pricing changes without proper communication can alienate customers. PE firms must ensure that pricing adjustments are paired with clear value communication and customer education. - Inconsistent Pricing Infrastructure

A lack of standardised processes and tools can undermine pricing efforts. Investing in robust pricing infrastructure—including dedicated teams, governance frameworks, and tools—is critical to sustaining improvements. - Competitive Pressures

Competitors may respond to pricing changes with aggressive tactics, such as discounting or bundling. Companies need to monitor market reactions and adapt accordingly to maintain their competitive edge. - Regulatory Constraints

Especially in industries with stringent regulations, pricing changes can attract scrutiny. Compliance must be factored into every pricing decision to avoid penalties or reputational risks.

What Private Equity Firms Should Prioritise

- Build Pricing Expertise: Establish dedicated pricing teams within portfolio companies or engage external pricing consultants to ensure a disciplined approach.

- Invest in Pricing Infrastructure: Equip companies with advanced tools for analytics, scenario modelling, and governance.

- Focus on Value Communication: Train sales teams to articulate the value proposition effectively, ensuring customers understand the rationale behind price changes.

- Regularly Review Pricing: Encourage portfolio companies to periodically assess their pricing strategies to align with market trends and competitive dynamics.

Unlock Your Pricing Potential with KABEN

At KABEN Partners, we specialise in helping private equity firms and their portfolio companies unlock value through strategic pricing. From post-acquisition pricing audits to value-based pricing transformations, or Pricing target model implementation our expertise ensures your pricing strategies drive measurable results.

Interested in learning more? Contact us directly to explore tailored solutions for your portfolio.